Table of Content

Your individual experience as to how helpful Medicare is when it comes to covering these types of expenses will vary based on the type of care you need and how long you need it, among other factors. For the most part, basic home health care services aimed at helping you get back on your feet and live a functional life are typically covered by most Medicare plans. If you need home health care services, it’s best to check with your plan administrator if you have specific questions about your coverage. Whether your home health care is covered by Part A or Part B, Medicare pays the full cost of services furnished by a participating provider. This means you don’t pay any deductibles or coinsurance toward your home care if you and your providers follow all Medicare requirements. Except for intermittent skilled care, there is no limit to the number of home visits Medicare will cover.

This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. To determine eligibility, Medicare defines “intermittent” care as fewer than seven days a week, or daily for less than eight hours per day for up to 21 days.

Original Medicare (Part A and/or B) will cover:

Additionally, coverage options and opportunities can change from one year to the next. If you have questions about Medicare or want to compare plans in your area, visit our website. We can help you learn about your options and find the best coverage for your needs.

Before you enroll, ensure that the doctors and specialists you need are included. Be sure to enroll during your initial enrollment period, which begins three months before you’re turning 65 and lasts seven months. This enrollment period begins on January 1 and ends on March 31. You can enroll in Medicare during this time, but the coverage won’t start until July 1 of the same year. The procedures covered, copays, and deductible amounts will depend on the plan you choose. Whether you're new to Medicare or you're preparing for an open enrollment period, it's common to have questions about qualifications, coverage, and how you can get the best medical care within your budget.

Are You Automatically Enrolled In Medicare When You Turn 65

Healthline has strict sourcing guidelines and relies on peer-reviewed studies, academic research institutions, and medical associations. You can learn more about how we ensure our content is accurate and current by reading our editorial policy. Enrolling in these plans in a timely fashion is vital to making the plans as low-cost as possible. If you receive benefits from Social Security, the Railroad Retirement Board, or the Office of Personnel Management, these organizations will deduct the Medicare deductible before sending you your benefits.

If you’re enrolled in Original Medicare, you will use both Part A and Part B to cover limited home health services, says Parker. Most Medigap policies cover your cost in full, but benefits vary by plan. You are qualified for home health services if you have both Medicare Part A and Part B. You also must be homebound, under a doctor’s care and need at least one of the Medicare-covered services.

Martin Short on Rx savings

These services are also covered under Medicare Advantage — a Medicare-approved plan run by private insurance companies. “If it’s a benefit that’s offered under Original Medicare, it has to be offered under Medicare Advantage too,” says Miller. Home health care covers a wide range of treatment options that are performed by medical professionals at home.

Under Part B, individuals over 65 may purchase supplemental insurance plans that will cover the 20% that is not covered by Medicare. For our community, whenever possible, IDF recommends purchasing a supplemental plan, but supplemental plans may not be used to cover the coinsurance requirements under a Part D plan. With the price of Ig replacement therapy being up to $10,000 per month, Part D coverage is not sufficient to make it affordable for most people. Given that many people struggle to make their basic monthly living expenses, getting to the point of reaching catastrophic coverage is not a realistic option. An article in the Hill highlights the challenges to people when medications that should be covered by Part B are only covered by Part D.

Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area. NoteIf you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare.

To help pay these costs, you could turn to Medicaid, which helps some low-income people, pregnant women, and families cover their health care costs. In response to both these movements, many new home health care agencies have sprung up. You’re increasingly likely to find such an agency in your local area.

If you stop working or lose your employer-sponsored health insurance, you have eight months to sign up for Medicare without a penalty. Medicare is generally the first payer for your medical care, but Medicaid can provide coverage for things not covered by Medicare. If you have questions about Medicare or Medicaid, be sure to contact the appropriate state or Social Security office. A Medicare Savings Program can help lower-income Medicare recipients afford their out-of-pocket costs.

After the deductible, you’ll pay about 20% for each Medicare-covered service or item. It’s important to review all of your Medicare options before making a decision on what plan is right for you. If you have retirement benefits, be sure to speak with your employer benefits manager before making decisions.You’ll want to compare monthly premiums, coverage, and out-of-pocket costs before you move forward. Intermittent skilled nursing care , physical therapy, speech-language pathology services or continued occupational therapy.

If this happens, you may have to pay some or all of the costs. Ask questions so you understand why your doctor is recommending certain services and if, or how much, Medicare will pay for them. NoteIf you get services from a home health agency in Florida, Illinois, Massachusetts, Michigan, or Texas, you may be affected by a Medicare demonstration program. Under this demonstration, your home health agency, or you, may submit a request for pre-claim review of coverage for home health services to Medicare.

However, if you make $500,000 or more as an individual or more than $750,000 as a couple filing jointly, you will pay $578.30 per month for your Part B premium in 2022. If you require full-time care, other options besides home health care need to be explored. During the COVID-19 pandemic, nurse practitioners, clinical nurse specialists, and physician assistants can provide home health services, without the certification of a physician. Sign up to receive news and helpful resources on your phone and/or your email inbox.

ways to find out if Medicare covers what you need

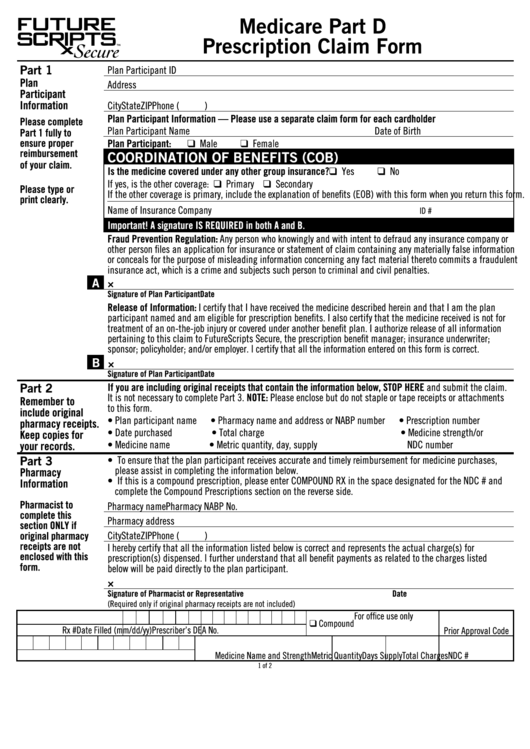

Medicare Part D is an optional add-on plan to your Medicare coverage that helps pay for the cost of prescription drugs as well as many vaccines. You can also get Medicare Part D as part of your Medicare Advantage Plan if you choose a plan with drug coverage. There are several different parts to Medicare, each with its own costs and enrollment periods.

Medical coverage is one of the most important considerations for staying healthy as you age. Finding the coverage you need that fits within your budget is essential to ensure you don't face gaps in coverage. Different Medicare options are designed to provide choices based on your needs and supplemental coverage. If you're already receiving Social Security or Railroad Retirement benefits, you'll be automatically enrolled. Similarly, automatic enrollment in Medicare occurs for people under 65 who have been receiving disability benefits for 24 months or have ESRF or ALS.

No comments:

Post a Comment